1. Understand Sustainable Finance

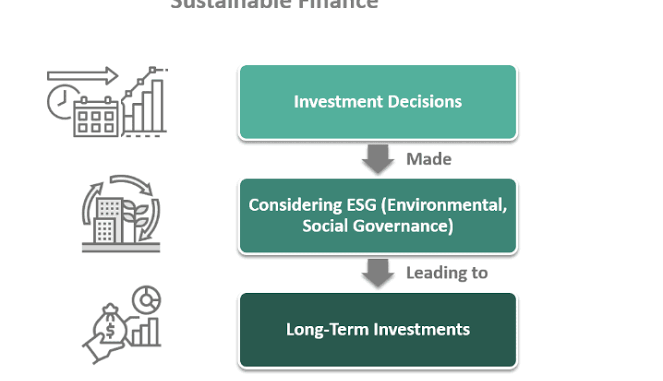

Sustainable finance refers to investment strategies that consider ESG criteria alongside financial returns. The goal is to support projects and companies that contribute to sustainable development while managing risks and achieving financial objectives.

2. Know the Key ESG Factors

Environmental: Assess how investments impact climate change, natural resource use, waste management, and pollution.

Social: Evaluate labor practices, community engagement, human rights, and diversity and inclusion.

Governance: Consider corporate governance practices such as board diversity, executive pay, and shareholder rights.

3. Explore Investment Strategies

Negative Screening: Exclude investments in sectors or companies that don’t align with your values (e.g., fossil fuels, firearms).

Positive Screening: Select investments based on their strong ESG performance and contributions to sustainable practices.

Thematic Investing: Focus on sectors or themes like renewable energy, clean water, or sustainable agriculture.

Impact Investing: Invest in projects or companies that aim to generate positive social and environmental impacts alongside financial returns.

4. Utilize ESG Ratings and Tools

ESG Ratings: Use ratings from agencies like MSCI, Sustainalytics, and Bloomberg to assess companies’ ESG performance.

Sustainability Reports: Review companies’ annual sustainability reports for insights into their ESG practices and achievements.

5. Consider Green Bonds and Funds

Green Bonds: Invest in bonds issued to fund environmental projects, such as renewable energy or energy efficiency initiatives.

Sustainable Funds: Look for mutual funds or ETFs that focus on ESG criteria and sustainable investments.

6. Engage and Advocate

Shareholder Engagement: Exercise your voting rights to influence corporate governance and ESG policies.

Advocacy: Support initiatives and policies that promote sustainability and corporate responsibility.

7. Stay Educated and Informed

Research: Continuously educate yourself about the latest trends, regulations, and innovations in sustainable finance.

Networking: Connect with other investors, financial advisors, and experts in the field to share insights and strategies.

By incorporating these practices into your investment approach, you can contribute to a more sustainable and equitable future while managing risks and pursuing financial growth.